The finance industry has long been a target for fraudsters, and as financial crimes evolve, traditional systems struggle to keep pace. However, machine learning in finance has proven to be a transformative force, offering cutting-edge solutions for fraud detection and risk management. By harnessing the power of machine learning algorithms, financial institutions are better equipped to tackle fraud and manage risks with precision and efficiency.

This blog explores how machine learning is reshaping the finance sector by improving fraud prevention and optimizing risk management strategies.

Before diving into the application of machine learning in finance, let’s first define what it is. Machine learning is a subset of artificial intelligence (AI) that allows algorithms to learn from data and make predictions without explicit programming. These models continuously improve over time as they process more data, making them highly adaptable.

The key types of machine learning include:

If you’re new to machine learning and want to understand the basics, learn more about machine learning, including its definition, types, and tools.

Fraud is a significant challenge in the financial sector, costing billions globally every year. Traditional fraud detection systems are often static and fail to identify new types of fraud effectively. As financial transactions become increasingly digital, the need for advanced, real-time fraud detection systems has never been more urgent. Machine learning offers a powerful solution by analyzing large datasets and identifying hidden patterns that indicate fraudulent activity.

As reported by the Federal Trade Commission in 2023, consumers reported losing more than $10 billion to fraud, marking the first time that fraud losses have reached that benchmark. Investment scams accounted for over $4.6 billion of these losses, while imposter scams resulted in nearly $2.7 billion in reported losses.

In India, according to The Times of India report, cyber financial frauds led to losses of ₹22,845 crore in 2024, a staggering 206% increase from ₹7,465 crore in 2023. This significant escalation underscores the growing challenges in cybersecurity and financial fraud prevention.

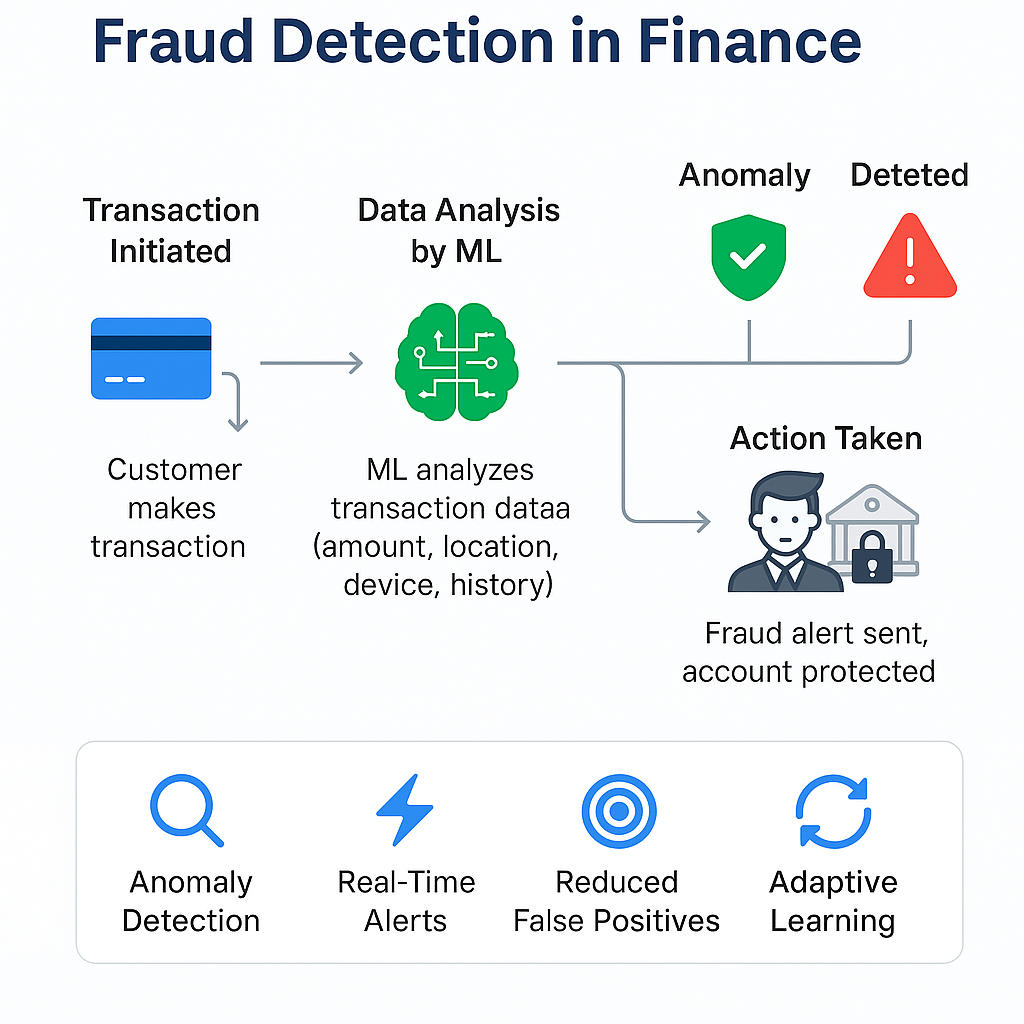

Machine learning is a key player in improving fraud detection in finance. Unlike traditional systems that rely on predefined rules, ML models continuously learn and adapt, detecting new and evolving fraud patterns.

By studying transaction patterns, machine learning can identify outliers that may indicate fraud. For example, if a customer who typically makes small purchases suddenly tries to make a large transaction abroad, machine learning can flag this as an anomaly and alert the institution in real-time.

ML algorithms can process vast amounts of data instantly, enabling financial institutions to detect fraud in real-time. This speed is crucial in preventing further damage and securing customer accounts.

Traditional fraud detection systems often trigger false positives, flagging legitimate transactions as fraudulent. Machine learning reduces these errors by analyzing a variety of features, such as transaction history, geolocation, and device data, to make more accurate predictions.

One of the greatest advantages of machine learning in fraud detection is its ability to learn from new data. As fraud patterns change, ML models adapt, improving their accuracy and detection capabilities over time.

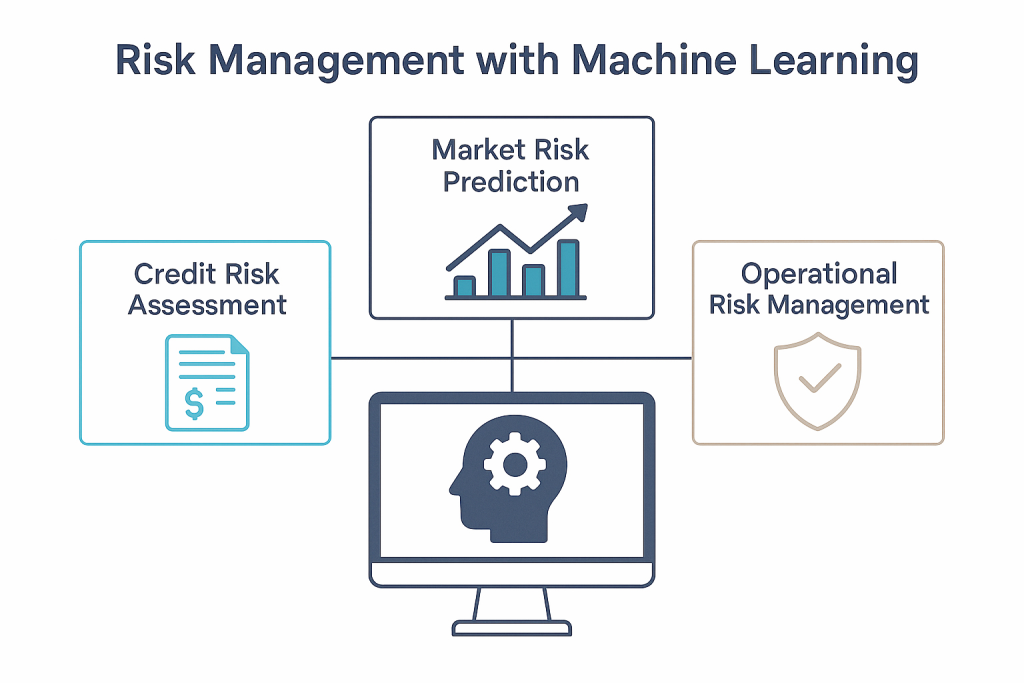

Risk management is another area where machine learning is making a significant impact. Financial institutions deal with various types of risks, including credit risk, market risk, and operational risk. Traditional risk management techniques can be slow and inaccurate, often relying on outdated data or simplistic models.

Machine learning offers a more dynamic and accurate approach to financial risk management:

Machine learning has revolutionized the way financial institutions assess credit risk. Traditional credit scoring models use limited data, but ML algorithms can analyze a broader range of factors, including spending behavior, transaction history, and even social media activity, to make more accurate credit decisions.

Machine learning models can analyze historical market data to identify trends and predict future market movements. This helps investors and traders make more informed decisions and reduce exposure to market volatility.

Machine learning also aids in identifying and mitigating operational risks by analyzing internal processes and flagging areas where errors or failures are likely to occur. This predictive ability helps institutions avoid costly mistakes and improve overall efficiency.

Adopting machine learning in the finance industry offers several advantages, including:

Machine learning models are far more accurate in detecting fraud and managing financial risk than traditional systems. By analyzing a vast array of factors, ML can provide a more comprehensive and precise risk assessment.

Machine learning enables real-time fraud detection and risk assessment, ensuring that financial institutions can act quickly to protect their customers.

ML algorithms can automate many processes, reducing the need for manual intervention. This leads to significant cost savings for financial institutions while improving the efficiency of fraud detection and risk management.

Machine learning allows institutions to create more personalized offerings for customers based on their behavior and preferences, enhancing the customer experience.

While machine learning offers immense potential, there are several challenges that financial institutions must overcome:

The future of machine learning in finance looks incredibly promising. As technology advances, we can expect even more innovative applications of machine learning in areas such as predictive analytics, automated compliance monitoring, and advanced fraud detection.

With the rise of quantum computing and blockchain integration, the possibilities for machine learning in finance are endless. In the coming years, we’ll likely see more sophisticated machine learning algorithms that provide even greater accuracy in fraud detection and risk management.

In conclusion, machine learning has transformed the way the finance industry handles fraud detection and risk management. With its ability to analyze vast amounts of data, detect anomalies in real-time, and provide more accurate assessments of financial risks, machine learning is helping financial institutions stay ahead of the curve in protecting both their business and their customers. As technology continues to evolve, we can expect machine learning to play an even greater role in shaping the future of finance. Interested in diving deeper into machine learning or AI? Join Gignaati’s courses to get hands-on training with expert-led modules and accelerate your career in AI!

Machine learning algorithms analyze large datasets and identify patterns that deviate from the norm, helping detect fraudulent activities in real-time.

Decision trees, neural networks, and anomaly detection techniques are commonly used for fraud detection in finance.

Machine learning enhances credit risk assessment by analyzing a wider range of data, providing a more accurate picture of a borrower’s creditworthiness.

Challenges include data privacy concerns, high implementation costs, and ensuring compliance with financial regulations.

Yes, machine learning enhances credit scoring by analyzing diverse data—like transactions, spending habits, and social media—to assess creditworthiness more accurately and minimize risky loan approvals..

Explore Gignaati.com – where top AI innovators showcase verified AI agents for real-world solutions.

© 2025 Gignaati is a product of Smartians.ai. All rights reserved.